We like Goodman Group (GMG)

Goodman Group has a Global Investment, Development and Management platform for Logistics and Industrial assets. With Assets under management of over $34 billion, and a development pipeline well in excess of $3 billion the company has a long list of reputable funds who continue to partner with Goodman Group in delivering and managing quality Industrial product. Goodman Group has an excellent track record of delivering earnings growth, and their market exposure, their client list and the appetite for their products and services globally positions them well for the next 5 years.

Goodman Group is a profitable, defensive way to play the increasing global penetration of e-commerce. Goodman Group already has a strong relationship with e-commerce behemoth, Amazon. Goodman Group has leased 3 sites to Amazon in Europe and has recently completed and leased a facility for them in California. Furthermore Amazon has flagged a very significant need for more large logistic centres as well as a need for Amazon Fresh sites closer to their end markets.

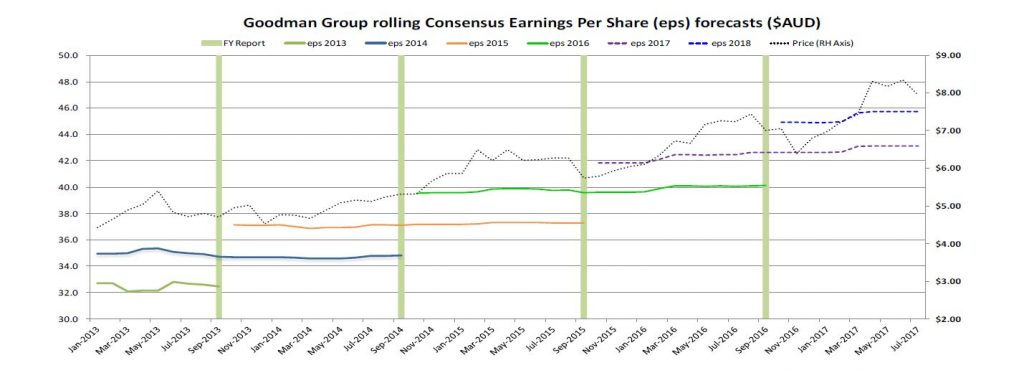

Goodman Group’s history with Amazon should put them in a solid position to build and rent more product to Amazon in the US, Europe and UK as well as Australia where Goodman has numerous quality sites that should appeal to Amazon’s growing needs. We believe Goodman Group is attractively priced on a 1 year forward PE of 17x in the context of mid-high single digit EPS growth rates, a solid balance sheet and significant longer-term growth options.

We are cautious some consumer facing sectors

The retailing landscape has changed considerably over the last 5 years. Over this time we have seen the arrival of global operators such as H&M, Uniqlo, Zara and Top Shop to name a few in the discretionary space, and discounters such as Aldi and Costco in the staples space. All of these operators have 2 things in common: lower cost structures, and a willingness to accept lower EBIT margins.

The more recent online threat only accelerates the structural changes facing the industry. Australia is running at much lower online penetration than other countries such as the UK and the USA. Amazon has taken space in Australian office and there has been much speculation about them taking logistic space. When Amazon moved into other regions, the impact on existing retailers was significant, and Australia is not expected to be different despite the geographic challenges.

Existing retailers are adapting, and investing in their online offering. The only problem is that overall online sales growth continues to outpace in-store sales growth putting at risk foot traffic into traditional bricks and mortar outlets. These changing consumer behaviours will likely impact retail REITs as retail margins are impacted and demand for physical store space is reduced.

New entrants and on-line competition is further exacerbated by increasing consumer headwinds. Rising costs (electricity, property affordability, interest rates) combined with low wages growth has seen consumer spending slow to the lowest since the GFC. Retailers large and small have found this environment challenging.

We are cautious some consumer facing sectors

The retailing landscape has changed considerably over the last 5 years. Over this time we have seen the arrival of global operators such as H&M, Uniqlo, Zara and Top Shop to name a few in the discretionary space, and discounters such as Aldi and Costco in the staples space. All of these operators have 2 things in common: lower cost structures, and a willingness to accept lower EBIT margins.

The more recent online threat only accelerates the structural changes facing the industry. Australia is running at much lower online penetration than other countries such as the UK and the USA. Amazon has taken space in Australian office and there has been much speculation about them taking logistic space. When Amazon moved into other regions, the impact on existing retailers was significant, and Australia is not expected to be different despite the geographic challenges.

Existing retailers are adapting, and investing in their online offering. The only problem is that overall online sales growth continues to outpace in-store sales growth putting at risk foot traffic into traditional bricks and mortar outlets. These changing consumer behaviours will likely impact retail REITs as retail margins are impacted and demand for physical store space is reduced.

New entrants and on-line competition is further exacerbated by increasing consumer headwinds. Rising costs (electricity, property affordability, interest rates) combined with low wages growth has seen consumer spending slow to the lowest since the GFC. Retailers large and small have found this environment challenging.